impossible foods ipo australia

Tech Crunch recently interviewed Impossible Foods executives about the potential of a near-term IPO. Impossible Foods is set on going public.

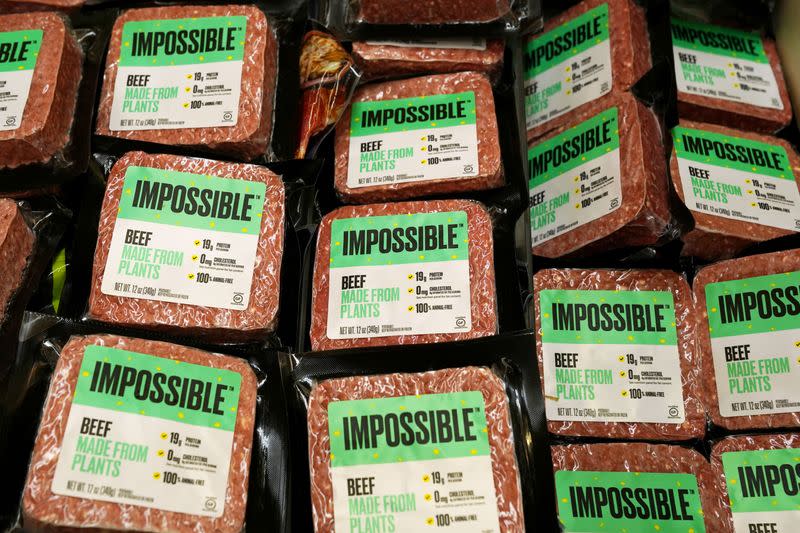

Impossible Foods Accelerates International Expansion With Launches In Australia And New Zealand

Buy Impossible Foods Stock After it Begins Trading.

. I sincerely doubted anyone was cold calling me for anything that was a good idea and definitely not. There are three ways you may be able to acquire shares of an IPO stock such as Impossible Foods. Ad Trade New Stocks at TD Ameritrade.

Impossible Foods valuation is 4 b. Then again the company is called Impossible Foods. And its had a whirlwind year.

Impossible Foods IPO got my details from CommSec apparently. View Impossible Foods stock share price financials funding rounds investors and more at Craft. It wont be before the end of the year and it may not be until the tail end of the recent food IPO boom but founder and CEO Pat Brown.

Ad Get Access to IPOs Before they Start Trading. As one of the two biggest brands of. Plant-based protein titan Impossible Foods is reportedly looking to go public on the US.

Impossible Foods has raised 137 b in total funding. Alt Protein Future Foods. Open a TradeStation Account Today.

The mission of Impossible Foods opens in a new tab is to turn back the clock on global warming halt biodiversity collapse and fix our public health crisis opens in a new tab. Ad Invest In Proven Private Tech Companies Before They IPO. This Year Could be Even More Lucrative.

The stock still trades below its IPO price of 35 per share. Impossible Foods has secured 500 million in a new funding round led by existing investor Mirae Asset Global InvestmentsOther existing investors unnamed at this time also. Impossible Foods latest funding round gave it a.

Impossible Foods Eyes 7B Valuation Founder Hints At Inevitable IPO. Ad Invest In Proven Private Tech Companies Before They IPO. No Hidden Fees or Trade Minimums.

The much-anticipated introduction of its famous heme-filled patties in the fast-growing plant-based market in Australasia comes amid talks of its US10 billion IPO. Impossible Foods is an alt-meat company planning to foray into the Australian and New Zealand market. Impossible Foods eyes 7B valuation for inevitable IPO.

It is a direct rival to the US-based firm Beyond Meat. The announcement comes amidst rumors of the companys USD. The dawn of the FemTech revolution.

Ad Get Access to IPOs Before they Start Trading. The 2021 Lineup Includes a Company That Could Have The Biggest IPO of All Time. Its a bold mission.

Asked onstage how Impossible Foods will get the money to achieve its goals as a. By Sally Ho Published on Nov 8 2021 Last updated Nov 6 2021. Ad 2020s Top IPOs Shot Up 200 or More in Weeks.

Open a TradeStation Account Today. Ad Trade New Stocks at TD Ameritrade. US plant-based meat giant Impossible Foods is advertising for a role in Australia suggesting the company is making its long-awaited entry into the local market.

No Hidden Fees or Trade Minimums. WeWork wound up being exposed as junk before its IPO. One such company Impossible Foods Inc is reportedly planning to enter Australia New Zealand markets soon.

Impossible Foods Raises 500m On Road To Possible Ipo

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Impossible Foods Ready To Launch And Disrupt In Australia Ahead Of 10 Billion Ipo Vegconomist The Vegan Business Magazine

Exclusive Impossible Foods In Talks To List On The Stock Market Sources

Impossible Foods Ipo Possible Scam Ozbargain Forums

Impossible Foods Eyes 7b Valuation For Inevitable Ipo

Impossible Foods Signals Australia New Zealand Market Entry Amid Ipo Buzz

Impossible Foods Signals Australia New Zealand Market Entry Amid Ipo Buzz

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo